Change EFIN

If you have a new EFIN you will need to change within our software, you will need to make sure you change your EFIN with your Software Specialist.

You will need a copy of the IRS EFIN letter faxed to us at 1.866.386.5473.

Once we receive this letter, we can change your EFIN in the system. The new EFIN will generate a new registration code.

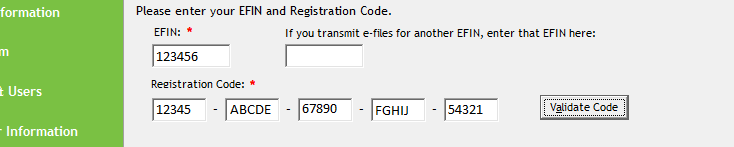

You will need to change your EFIN in the Setup Assistant, along with enter the new registration code provided in the email and displayed in your Customer Portal.

(For detailed assistance with changing the Registration Code, please see this section of the Solution Center.)

Next, you will want to ensure that the EFIN is changed in the Tax Form Defaults if previously entered there. Please check out this article for changing information in the Tax Form Defaults.

If you have created any E-files for returns that have not been sent yet, you will need to do the following to ensure they recreate with the correct information:

- Open the return that has an E-File created already but not sent yet.

- Temporarily change the return type to Paper on the Main Info sheet, this will make the 8879 inactive.

- Right click on the 8879 in the Forms Tree on the left and select Remove Form.

- Switch the return type back to E-File Only or Bank Products, whichever is appropriate.

- The new 8879 that is added should pull in the correct EFIN that was added to the Tax Form Defaults in the steps above.

- Run Diagnostics and create a new E-File to overwrite the current one in Send Return.

Tags: install,setup

Support Center

Support Center