<- Back to Main Page

Tags: reject,federal

Reject Code IND-35 - PriorYearPIN or PriorYearAGI must match

Error Reject Code IND-35 'SpousePriorYearPIN' or 'SpouseElectronicFilingPIN' or 'SpousePriorYearAGI' in the Return Header must match the e-File database.

Also, if you don't want the Prior Year AGI or Prior Year PIN to be required, this will make it so it's no longer required.

The same goes for *TaxPayer* as well.

/efile:Return/efile:ReturnHeader/efile:Filer/efile:SpouseSSN

How to Fix: The TaxPayer or Spouses Prior Year AGI/PIN/Filing PIN doesn't match what the IRS shows in their database for this SSN.

This is a VERY easy fix. Just follow the following steps:

- Open return

- Go to the Main Information Sheet

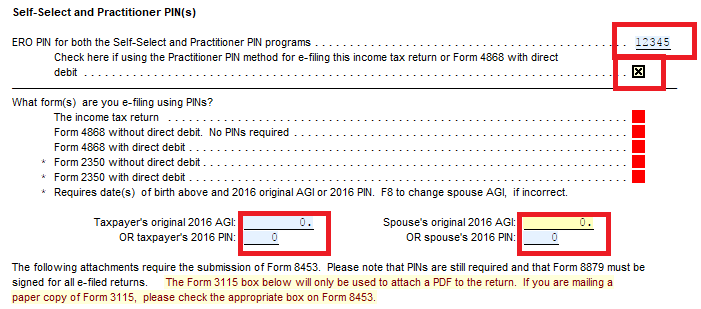

- Go towards the bottom of the Main Info Sheet and look for the section Self-Select Practitioner PIN

- Look at the checkbox under the box where you put the PIN that is next to "Check if using the Practitioner PIN method for e-filing this income tax return or Form 4868 with direct debit" and check this box

Now you can delete the information you have listed in the Taxpayer's/Spouse's original 20XX AGI and 20XX PIN fields

Tags: reject,federal

Support Center

Support Center