Using Capital Gains Worksheet with 8949 and Sch D.

When working with Capital Gains, the 8949s and the Sch. D, ensuring that all the formatting is correct can be confusing. We understand that there can be a lot of transactions reported during this process and want to help make sure you only have to input them once!

When entering the information into the program, it’s best to start with the Capital Gains worksheet and work backward from there as the program is set up with specific codes for flowing the information to their respective locations without having to type it again.

To get to the Capital Gains worksheet, follow these steps:

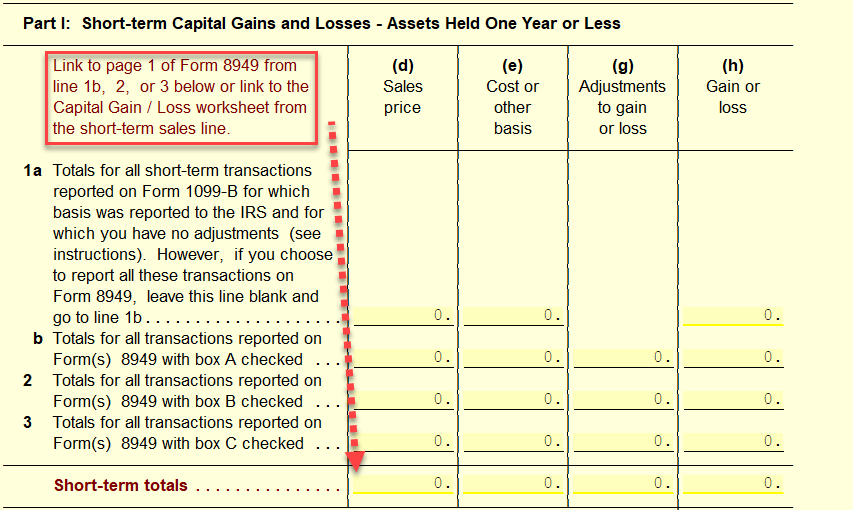

- Add the Sch. D to the return

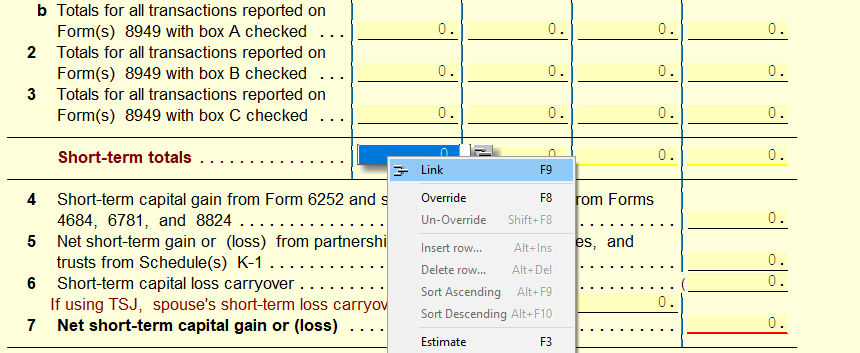

- On the Sch. D, navigate to either the Short Term Total or Long Term Total fields, right-click, and select link.

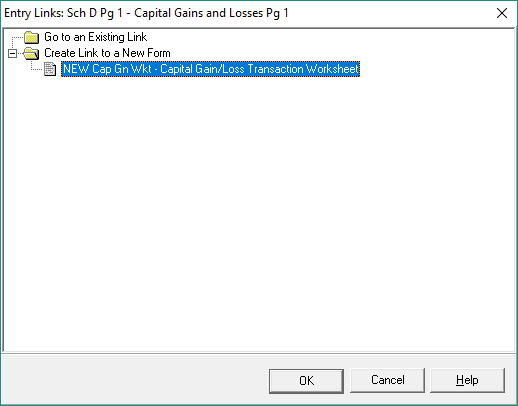

- With the Link window open, select the option for a new Capital Gain/Loss Transaction Worksheet.

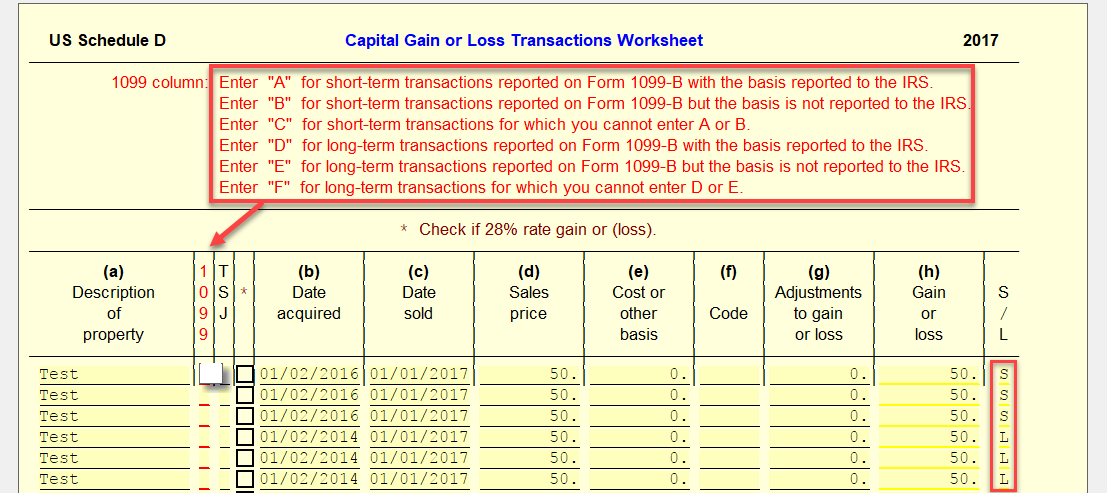

Once you have a Capital Gain worksheet added to the return, fill in all the applicable fields for each transaction from your client.

A couple of keynotes when working with the Capital Gain worksheet:

- The 1099 column is used in conjunction with the letter codes listed above it. A, B, and C are used for shorts, along with D, E, and F, being used for long. By entering the correct code for the transaction, the needed 8949 will pull into the return.

- Based on the dates that are entered in for the transaction, an automated field to the right will show if it is a Short or Long based off of time.

- If you need more spaces than what is provided on one sheet, you can select the Copy Cap Gn W (Shift+F10) tab at the top of the window for additional forms.

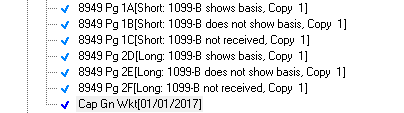

Once the needed 1099 codes have been entered, the program will automatically open the needed 8949 forms and add the transactions to it. You will see this happen in the forms tree on the left-hand side.

If you need additional assistance with the 8949, please see our article here.

Tags: federal,form

Support Center

Support Center