<- Back to Main Page

Tags: federal,form

Should Be Calculating EIC, But is Not...

- Is the Main Info Sheet completely filled out with the EIC box in the dependent information section marked with an X?

- Is the correct birth date entered for the child, and is the relationship a qualified relationship (see the 1040 instructions)?

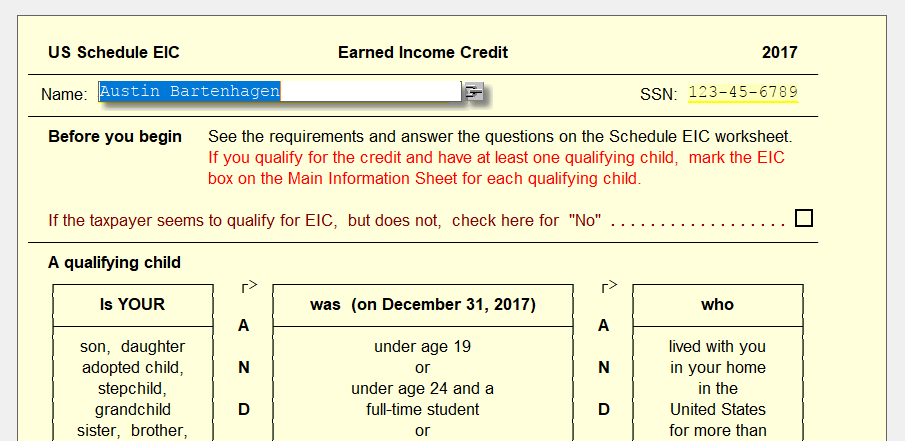

- Read the questions at the top of the EIC worksheet.

- Check Questions 11-17. These questions calculate for you. The information on each question tells you if you can continue with the next question.

- Does the Taxpayer not have any dependents?

- If the taxpayer does not have qualifying children, make sure that you correctly entered the birth date on the Main Info Sheet and that the taxpayer is over age 25, but under age 65.

- Does the taxpayer, spouse and/or qualifying children have valid social security numbers?

- If any of them have an ITIN/ATIN they do not qualify for EIC.

- Is the question at the top of the Schedule EIC Form marked If the taxpayer seems to qualify for EIC, but does not, check here for "No"?

- If this box is marked EIC will not calculate.

- Note: A scenario that this boxed should be checked would be if someone else in the household made a majority of the household income, but did not claim the current taxpayer as a dependent, even though they could be.

Tags: federal,form

Support Center

Support Center