Form 1099-C/Cancellation of debt

The SureFire program does not have a 1099C. Cancellation of debt income has many factors that contribute to whether or not the income is taxable. Due to this, Form 1099-C for cancellation of debt is not currently in the SureFire system. If you need to enter this information into a return you will enter that information on the 1040 line 21.

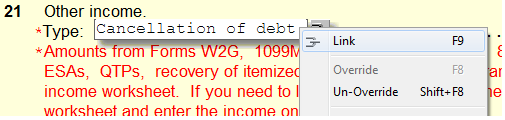

To do this you will link the 1040 worksheet 7 to line 21 where it says other income. To link the form click on the line and press F9 or right-click and choose link.

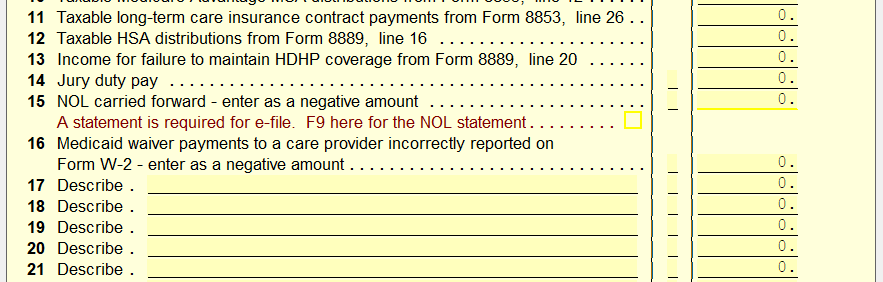

Enter in information on 1040 worksheet 7, it will automatically carry over to the 1040 pg 1 line 21. You will notice that there is not a line for 1099-C information, you will need to use one of the description lines (17-30) and enter something along the lines of "1099-C" or "Cancellation of debt."

You can also use form 982 to enter in this information. Whichever applies to the return in question.

Tags: federal,form

Support Center

Support Center