Earned Income Credit

If the filing status is married filing separately, the client cannot get the earned income credit.

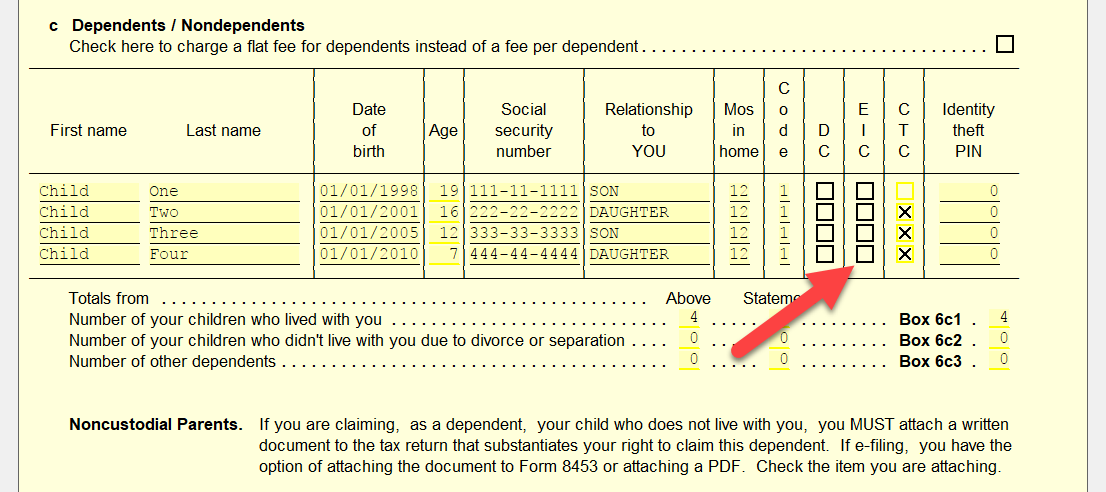

You must have entered the taxpayer's birth date on the Main Information Sheet and selected the EIC checkbox for qualifying children in the Dependents section of the Main Information Sheet. You also must complete the EIC worksheet.

For example, all of the dependents in this return qualify, so the EIC checkboxes will need to be selected.

Once completed, you can see at the bottom of the form the program automatically generates the amount of EIC that the taxpayer is eligible for and will send this information to the 1040.

If the taxpayer appears to qualify, but does not, select the checkbox at the top of Schedule EIC labeled, If the taxpayer seems to qualify for EIC, but does not, check here for "No".

EIC phases out when taxpayers reach the upper earned income limit (as calculated for EIC purposes).

For 2017, those limits are:

- With three or more qualifying children, $48,340 ($53,930 if married filing jointly)

- With two qualifying children, $45,007 ($50,597 if married filing jointly)

- With one qualifying child, $39,617 ($45,207 if married filing jointly)

- With no qualifying child, $15,010 ($20,600 if married filing jointly)

For 2016, those limits are:

- With three or more qualifying children, $47,955 ($53,505 if married filing jointly)

- With two qualifying children, $44,648 ($50,198 if married filing jointly)

- With one qualifying child, $39,296 ($44,846 if married filing jointly)

- With no qualifying child, $14,880 ($20,430 if married filing jointly)

For 2015, those limits are:

- With three or more qualifying children, $47,747 ($53,267 if married filing jointly)

- With two qualifying children, $44,454 ($49,974 if married filing jointly)

- With one qualifying child, $39,131 ($44,651 if married filing jointly)

- With no qualifying child, $14,820 ($20,330 if married filing jointly)

For 2014, those limits are:

- With three or more qualifying children, $46,997 ($52,427 if married filing jointly)

- With two qualifying children, $43,756 ($49,186 if married filing jointly)

- With one qualifying child, $38,511 ($43,941 if married filing jointly)

- With no qualifying child, $14,590 ($20,020 if married filing jointly)

For 2013, those limits are:

- With three or more qualifying children, $46,227 ($51,567 if married filing jointly)

- With two qualifying children, $43,038 ($48,378 if married filing jointly)

- With one qualifying child, $37,870 ($43,210 if married filing jointly)

- With no qualifying child, $14,340 ($19,680 if married filing jointly)

Tags: federal,form

Support Center

Support Center