Filling out a Sch. C

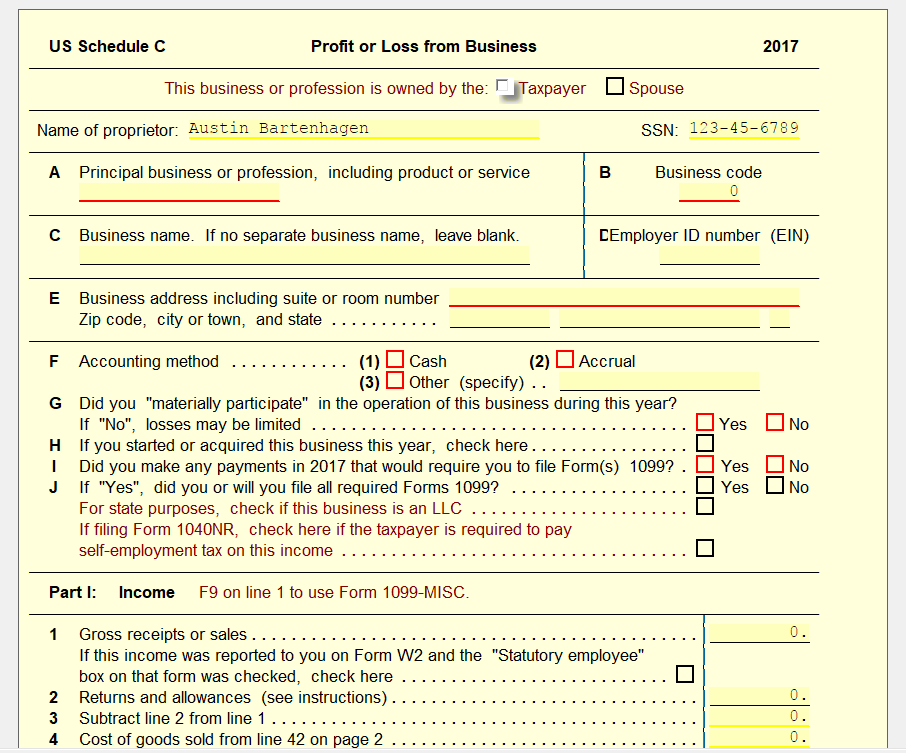

Adding a Sch. C to the return can be done by selecting Link on line 12 of the 1040 form.

Commonly with a Sch. C, the taxpayer may have a 1099 MISC form to report Non-employee Compensation. This can be done by Linking to 1099 MISC from Line 1 of the Sch. C. You will be able to enter all the information that shows on your taxpayer’s 1099.

Below the Income section, you will also notice the options to list expenses that may have occurred with the business, along with Depreciations on line 13.

Over on Pg. 2, you will also see locations for Costs of Goods Sold, along with Vehicle Information, and Other Expenses. If needing more line for expenses than what’s provided, just link to the Other Expenses Worksheet to one of the Other Expenses lines.

Tags: federal,form

Support Center

Support Center