<- Back to Main Page

Tags: federal,form

Filling out a Sch. D

Adding the Sch. D to the return can be done by linking to it via Line 13.

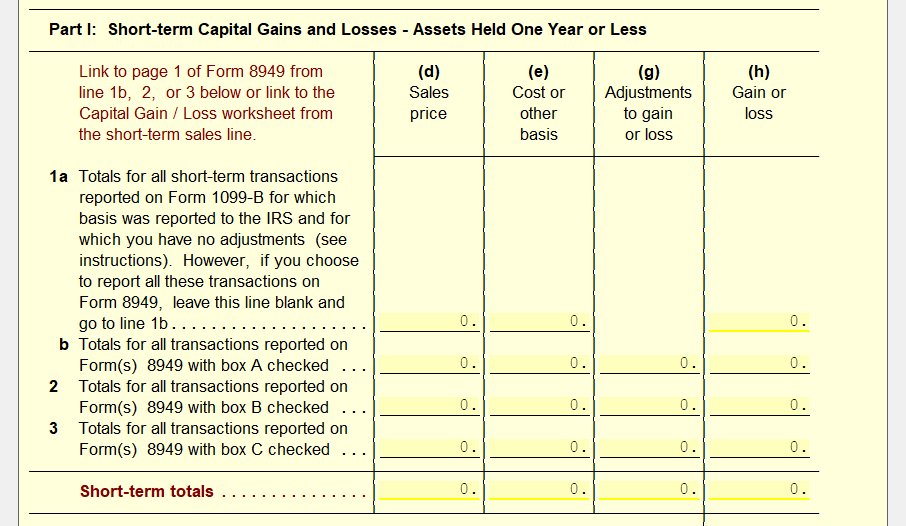

On the Schedule, the primary locations listed are for Short-Term and Long-Term transactions.

The best way to report Capital Gains and losses, be it shorts or longs, is to use the Capital Gain Worksheet. It can be linked to through the Total line under either section. This allows you to list out the information from 1099-B forms in detail, and also ensures that the program can allocate each transaction to the correct 8949.

For more information regarding the Capital Gain Worksheet and 8949’s, see our Solution Center article here: (Add a link to Capital Gain article)

Tags: federal,form

Support Center

Support Center