Form 1040X - Amended Individual Income Tax Return

Use this form to correct Forms 1040, 1040A, 1040EZ, 1040NR, or 1040NR-EZ. If you need to prepare an amended return for a previous year, you must use the SureFire program for that year.

A person must file a separate Form 1040X for each year he or she is amending. If the person is changing the federal return, he or she may also have to change the state return. It often takes 2 to 3 months to process Form 1040X.

You must mail Form 1040X to the IRS. It cannot be filed electronically.

Form 1040X must be filed only after the taxpayer has filed the original return. Generally, for a credit or refund, Form 1040X must be filed within 3 years after the date the original return was filed or within 2 years after the date the tax was paid, whichever is later.

A Form 1040X based on a net operating loss carryback or a general business credit carryback generally must be filed within 3 years after the due date of the return for the tax year of the net operating loss or unused credit.

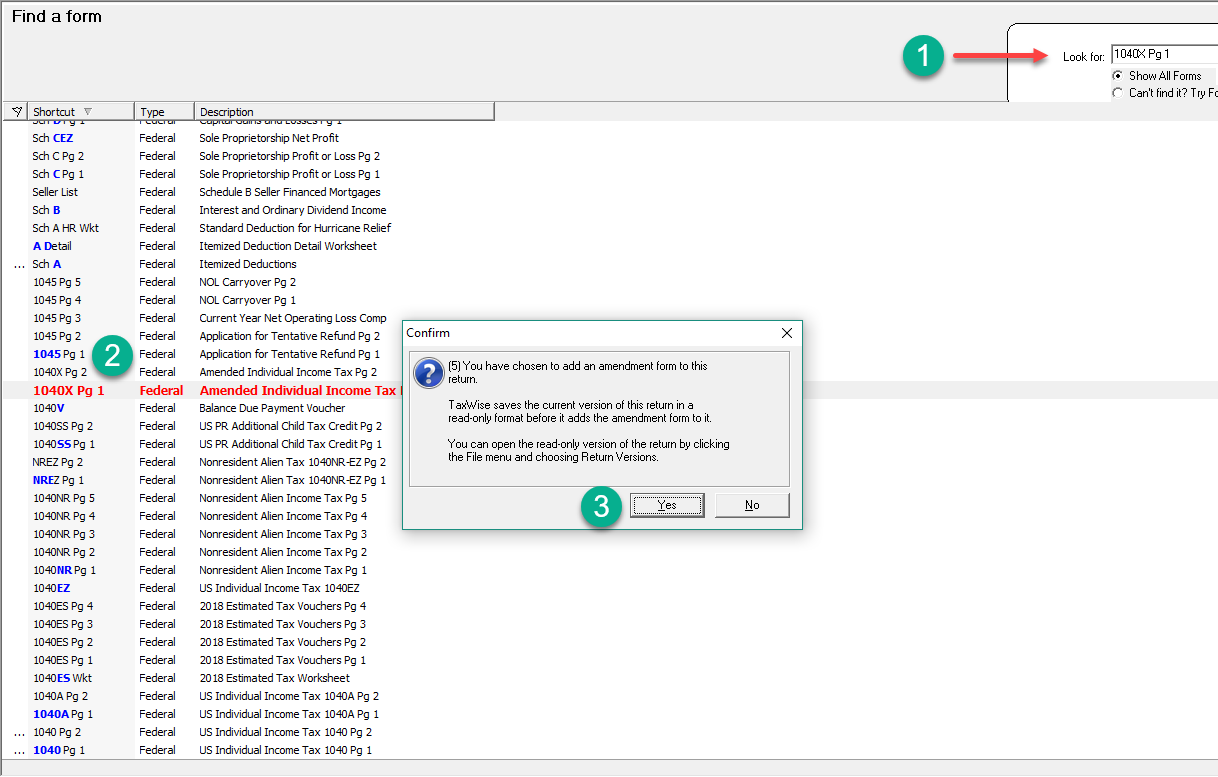

Making changes to an existing return:

- Open the return in SureFire.

- Select 1040X from the forms list.

- Click Yes.

- SureFire opens Form 1040X.

Before changing the return, you should print a copy of the original return for your records if you have not done so already.

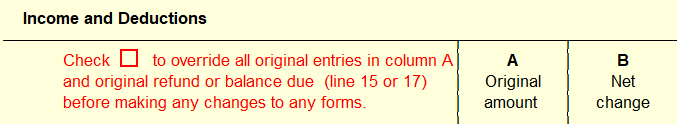

Before making any changes to the federal or state return, do the following:

Open Form 1040X and select the checkbox located above line 1 to override the original refund or balance due. When you select the checkbox, Sure-Fire overrides certain fields on this form containing information from the original federal return so that they will not change.

If you are also amending the state return and the state has a similar amend form, you must select a similar checkbox on the state amend form.

Making the changes

Next, make the necessary changes to the federal return. If you need to change the filing status or dependent information, do so on the Main Information Sheet. Add, remove, or change forms from the return as needed. Sure-Fire calculates the revised information to Form 1040X and the state amend form. Make changes directly on state forms only if necessary.

Finishing Form 1040X

Print Form 1040X and the state amend form and mail them to the IRS and state. Amended returns cannot be electronically filed.

Income and Deductions

Select the checkbox on line 1, if a net operating carryback is included in the amended return.

Tax Liability

Select the checkbox on line 7, if a general business credit carryback is included in the amended return.

Payments

Enter the amount of additional tax paid after the original return was filed below line 15.

Refund or Amount You Owe

Sure-Fire calculates the amount the client owes with Form 1040X, or the refund, whichever applies. If the client is getting a refund and wants to apply all or part of it to next year's estimated tax, enter the amount to be applied on line 22.

Part I: Exemptions

Before making any changes to the return you should have selected the checkbox located at the top of Form 1040X, page 1 to override the original refund or balance due.

If the number of exemptions or dependents do not change on the amended return, this section will not be completed.

All of the information on this page, except the date, is calculated from within the return.

Part II: Presidential Election Campaign Fund

A taxpayer and/or spouse may use Form 1040X to have $3 go to the fund if he or she did not do so on the original return. This must be done within 20-1/2 months after the original due date for filing the return. A previous designation of $3 to the fund cannot be changed.

Part III: Explanation of changes

Enter the line number for each item you are changing and give the reason for each change. Text does not wrap from one line to the next; each line is a separate text block.

Attach ONLY the supporting forms and schedules for the items changed.

Tags: federal,form

Support Center

Support Center