<- Back to Main Page

Tags: federal,form,install,web

Filing an 4868 extension for 1040 Individual

Sending this email out to everyone as a reminder on how to do an extension, and how to verify that its an extension was made.

To file an extension is pretty simple. To do so, on the main information sheet make sure to make which option you need. If they owe money to the IRS you want to mark 4868 with direct debit. If the client is getting a refund you want to mark 4868 without direct debit. No PINS required.

Once you have marked the 4868 it will populate that form in the forms tree. Simply fill that out. Once completed you can go ahead and e-File like normal. Just make sure the 4868 is being used by making sure that box is checked.

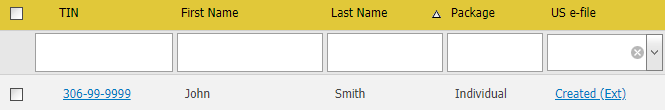

To verify that extension was created for the Web Version simply go under TAX RETURNS and look at the list and make sure it looks like this:

To verify that extension was able to be created for the Install Version after running diagnostics it will say extension e-File.

Tags: federal,form,install,web

Support Center

Support Center