<- Back to Main Page

Tags: install,federal,form

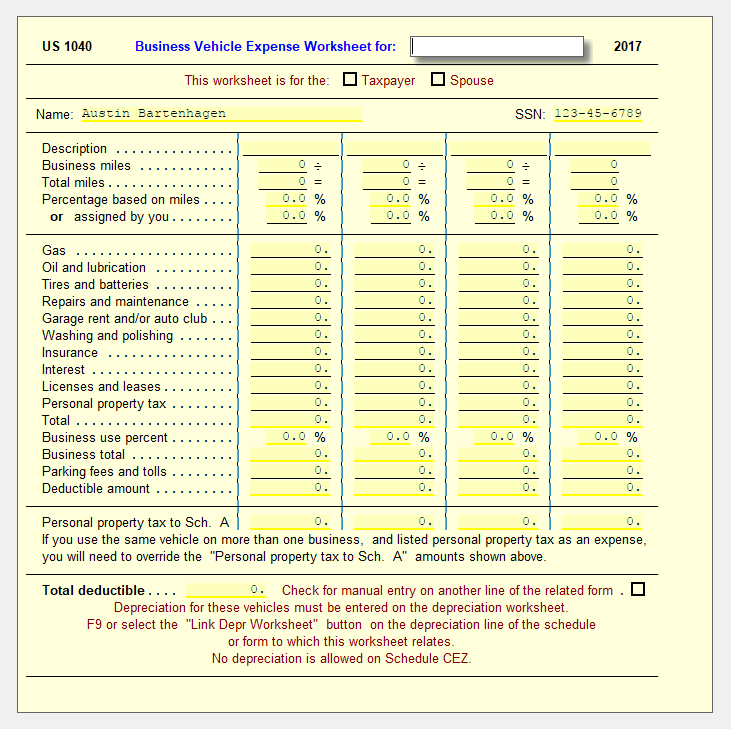

Listing Vehicle Expenses

You can use the Business Vehicle Worksheet to calculate the deductible amount of gas and other expenses for up to four vehicles per page.

To complete the Business Vehicle Worksheet:

- Go to Vehicle Wkt.

- Type the name of the individual or business at the top of the form.

- For each vehicle, enter the description of the vehicle, business miles, and total miles.

- SureFire calculates the percent of business use. You may skip the mileage entries and enter the percent of business use directly on the Business use percent line, if you wish.

- For each vehicle, enter your expenses.

- The worksheet totals the expenses and calculates the deductible amount based on the percent of business use.

- Parking fees and tolls are added in at 100%.

- This worksheet can be duplicated if you have more than four vehicles. Press Shift+F10 to duplicate the form.

- Depreciation for these vehicles must be entered by linking from Form 4562 to a Depreciation Worksheet. Use a separate worksheet for each vehicle.

Tags: install,federal,form

Support Center

Support Center