<- Back to Main Page

Tags: install,setup

Backing up your data

It is a good idea to back up your data daily. Be sure to write down pertinent information about each backup, such as the date, time, who performed the backup, etc.

You can use the Backup functions of Sure-Fire to:

- Copy tax returns and related files to a removable disk or to a folder on a different hard drive. You can back up returns from multiple user names and different packages together.

- Copy tax returns and related files to a removable disk for transfer to another computer.

- Copy the transmittal files for a return to a removable disk, so you can e-file the returns from a different computer.

- You should establish a separate regular backup procedure for your entire hard drive. There is commercially available software that performs well for short- and long-term data storage. Consult a reputable computer product supplier for the best product to meet your needs.

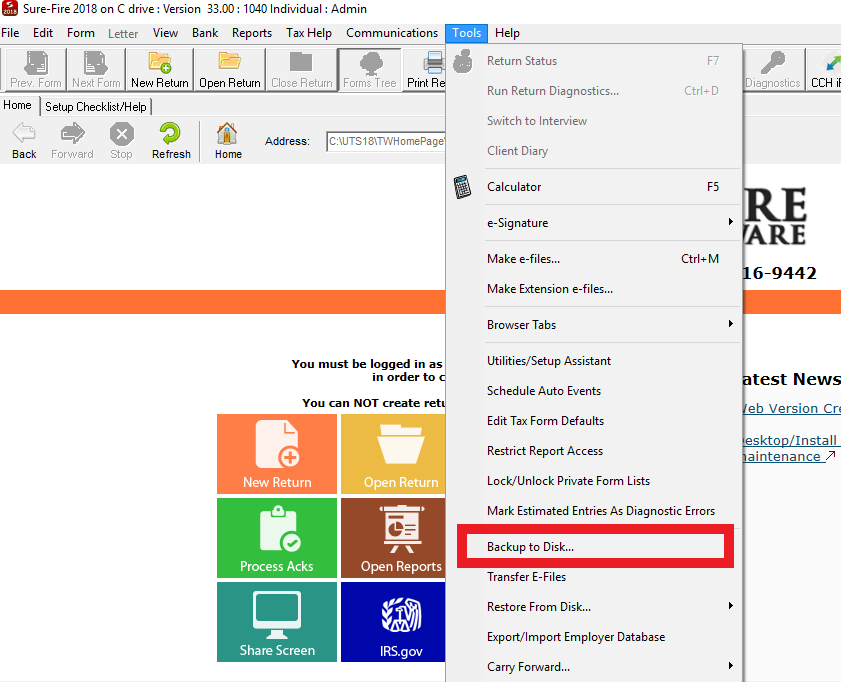

To back up returns:

- On the Tools menu, select Backup to Disk.

- In the Backup Options window, select Regular Backup, Transfer IRS/RAL Files to Transmitting PC, or Advanced Backup Options.

-Regular Backup: A backup option that only backs up your returns

-Archive Backup: A backup option that backs up returns, preparer information, and user settings - Select Start a new backup or Add to a previous backup, and then click OK.

- Continue to the appropriate procedure below.

To create a new backup:

- Follow the To back up returns procedure above.

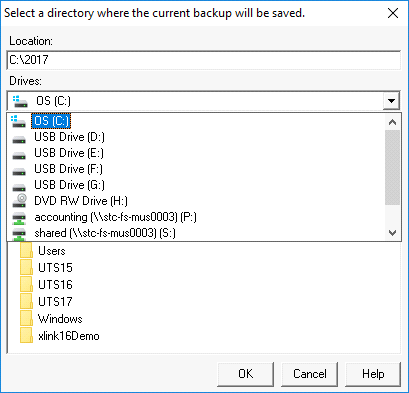

- In the Drives drop-down list, select the drive on which you want your backup file to be located.

- In the Directories drop-down list, select the directory where you want your backup file to be located.

Note: If you select a removable drive, be sure to have it connected to your computer before attempting to back up your data.

- Click OK to begin the backup process.

- When you add to an existing backup, Sure-Fire Tax copies the previous backup file to your hard drive, adds the new returns, and then copies the files to the designated drive. The new backup file (containing previous and new returns) replaces the old backup file.

- Before you can add to an existing backup file, you need to know the location of the backup file, because you will not be able to search through your files through the backup process. We recommend that you create a dedicated backup folder in which to save your backup files.

To add to a previous backup:

- Follow the To back up returns procedure above.

- Select the user under which the returns are located, and then click OK.

- Select the returns to back up, and then click OK.

- In the Drives drop-down list, select the drive on which your backup file is located.

- In the Directories drop-down list, select the directory where your backup file is located.

Note: If you select a removable drive, be sure to have it connected to your computer before attempting to back up your data.

- Click OK to begin the backup process.

Tags: install,setup

Support Center

Support Center